Ministry of Finance

and Corporate Relations

Budget 96

Jobs Up

Taxes Down

Debt Reduced

Budget Balanced

Message from Premier Glen Clark

On May 28, the people of B.C. gave my government a renewed mandate. And they sent us some very clear messages --

messages that we intend to act on.

People have told me they want to see health care and education protected.

They want us to continue to invest in young people and jobs.

This budget delivers on all counts.

And it helps out B.C. families and small business with income tax cuts, a tax freeze until the year 2000,

and freezes in BC Hydro rates, tuition fees and ICBC car insurance rates.

British Columbians have also told me they want us to cut the cost of government and reduce government debt. We're listening.

In our first term, we tackled British Columbia's $2.4-billion deficit. Now we take on the challenge of reducing B.C.'s provincial debt.

You deserve a government that listens to you and acts on your priorities.

Delivering that government is my commitment to you as premier.

Message from Finance Minister Andrew Petter

I am pleased to introduce my first budget to the people of British Columbia.

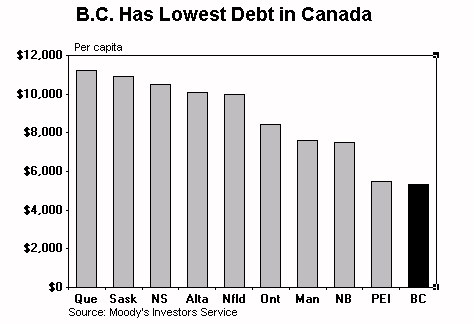

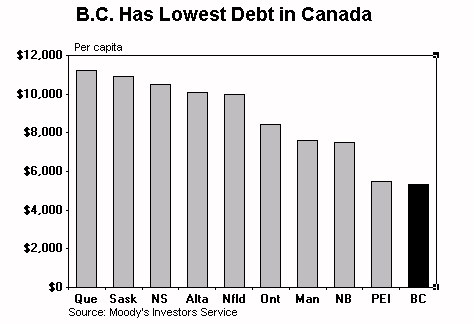

It is a budget that builds on the financial strength of B.C. -- having the best credit rating and lowest debt per capita of any

province -- with further measures to improve services while cutting costs. It does this through a leaner, but not meaner,

approach that provides a greater commitment to protect health care and education than any other government in the country.

And it is a budget that responds to the concerns raised by British Columbians to act on government debt with

a moratorium on capital spending and a comprehensive program review.

The 1996 budget strikes a balance between service delivery and solid financial management.

And it responds to the concerns raised by British Columbians during the election campaign.

Cutting the Size and Cost of Government

Actions to cut the size and cost of government spending and debt include:

- Reviewing government programs to cut costs and streamline bureaucracy.

- Freezing new capital spending until a review on capital projects is completed.

- Eliminating 2,200 positions from the public service this year, saving more than $210 million annually.

- Cutting the number of ministries from 18 to 15 -- the smallest number in over 35 years.

- Cutting spending in two-thirds of government ministries, to focus resources on priorities like health care and education.

- Eliminating two Crown corporations -- BC Systems Corporation and BC Trade -- saving taxpayers $71 million a year.

- Ending the gold-plated MLA pension plan.

- No wage increase this year for government employees.

- Reducing welfare caseloads -- May figures show that caseloads are down by 12,000 cases from the same time last year.

Budget Balanced

- The 1996 budget ensures that B.C. will continue to have the top provincial credit rating, lowest debt service costs,

and the lowest per capita debt in the country.

- B.C. will have a surplus of $87 million this year.

- Revenues for the next year will be up 2.6 per cent to $20.7 billion.

- Spending is estimated to be $20.6 billion, up 2.1 per cent -- half the rate of inflation and population growth.

- Real per capita cost of government is 2.2 per cent less than last year, and down 7 per cent since 1991.

Cutting Income Taxes for B.C. Families

- On July 1, the provincial personal income tax rate will be cut by one point and by a second point in 1997.

The reduction is capped for taxpayers earning more than $80,000.

- The home owner grant threshold is raised so that 96 per cent of B.C. homeowners receive the full grant.

- The budget also increases the threshold for the property transfer tax so that more first-time home buyers will

be exempt from the tax -- saving them up to $3,500.

Taxes Frozen To The Year 2000

- New legislation freezes taxes and prohibits any new taxes on individuals and families to the year 2000.

Hydro Rates, ICBC Fees Frozen

- BC Hydro residential rates are frozen for three years.

- ICBC rates are frozen for two years.

Cutting Taxes for Small Business

To support job creation by small businesses, the sector of the economy that creates the most jobs:

- On July 1, 1996, the small business income tax rate is cut by 10 per cent.

- A two-year income tax holiday will be in effect for new small businesses.

- Combined, these measures will save small businesses $29 million a year.

Government Debt Drops

- Total government debt will decline by $99 million this year. Direct debt will fall by $53 million.

- B.C.'s debt servicing costs are less than 8 cents for every dollar of revenue Ñ the lowest in Canada.

- B.C.'s credit rating is the best of any province in Canada.

- The debt management plan will eliminate the government's direct debt over 20 years.

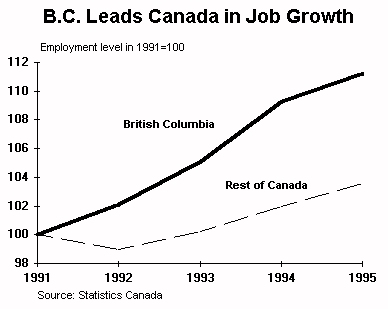

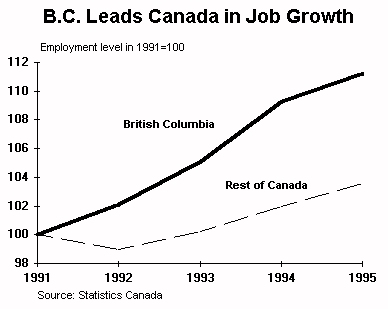

Canada's Best Record of Job Creation

- B.C. -- Canada's strongest economy -- has created 177,000 new jobs since 1992, and will create another 40,000 jobs this year.

- Special efforts will be made to protect the B.C. salmon fishery, coastal communities and related jobs.

A number of new initiatives announced in recent months will mean thousands of new jobs for working men and women. This includes:

- 21,000 more forest sector jobs in partnership with the industry.

Through this partnership, B.C. will get more value and jobs from every tree cut in the province.

- A new partnership with the tourism industry that will help create 23,000 new jobs in that sector over the next five years.

Making Our Communities Safer

This budget provides funding to keep our communities and streets safe. New initiatives include:

- Establishing a major crime investigation unit, in co-operation with the RCMP, to investigate unsolved murders

and other crimes, using advanced technology such as DNA fingerprinting.

- Fighting prostitution, getting tough on the pimps who profit from prostitution and the johns who keep it going.

- Getting young people off the streets, providing them with positive alternatives to violence and crime.

The Nights Alive initiative operates in 20 communities across the province. It uses school and recreational centres

after hours for sports, arts, music, and other activities chosen and organized by local youth.

Guarantee for Youth

A Guarantee for Youth provides B.C.'s young people with the education, skills, training, and job opportunities they need through:

- Tuition freeze -- the government is helping to keep post-secondary education affordable by freezing post-secondary

tuition fees for two years.

- Access to spaces -- the government is guaranteeing post-secondary spaces for every qualified

student, creating 7,000 new spaces this year.

- Access to jobs -- the Guarantee for Youth is creating 11,500 job opportunities in partnership with the private sector.

The government has also introduced Youth Works -- a BC Benefits initiative that will provide training and work experience

this year for more than 20,000 young people on welfare.

Protecting Health Care and Education

The B.C. government is making the strongest commitment of any provincial government to ensure that health care

and education are protected.

Action taken includes:

- Increasing hospital funding by 2.5 per cent over 1995 levels.

- Providing new funding to reduce waiting lists for heart surgery, cancer treatment, and hip and knee replacement surgery.

- Ensuring health care spending reflects population growth and cost pressures.

- Establishing a new B.C. Health Care Scholarship so health care workers can upgrade their skills.

The scholarship will help 300 eligible health care workers with an annual scholarship valued at $3,500, to a maximum of four years.

- Increasing public school funding by 3.5 per cent, accommodating population growth.

- Protecting funding for students in special education, aboriginal education, school meal and inner city school programs.

- Building and expanding hundreds of schools since 1991 to create more than 55,000 new spaces for students.

Budget '96 (Province of B.C.)

BC Ministry of Finance and Corporate Relations

BC Ministry of Finance and Corporate Relations

If you have questions or comments about content please contact: Communications